Dmitriy's Aviation Insights

Explore the world of aviation with expert tips and inspiring stories.

Insurance Showdown: Who's Got the Better Deal?

Uncover the ultimate insurance showdown! Who truly offers the best deals? Dive in and find out where your savings lie!

Comparing Insurance Policies: Finding the Best Value for Your Money

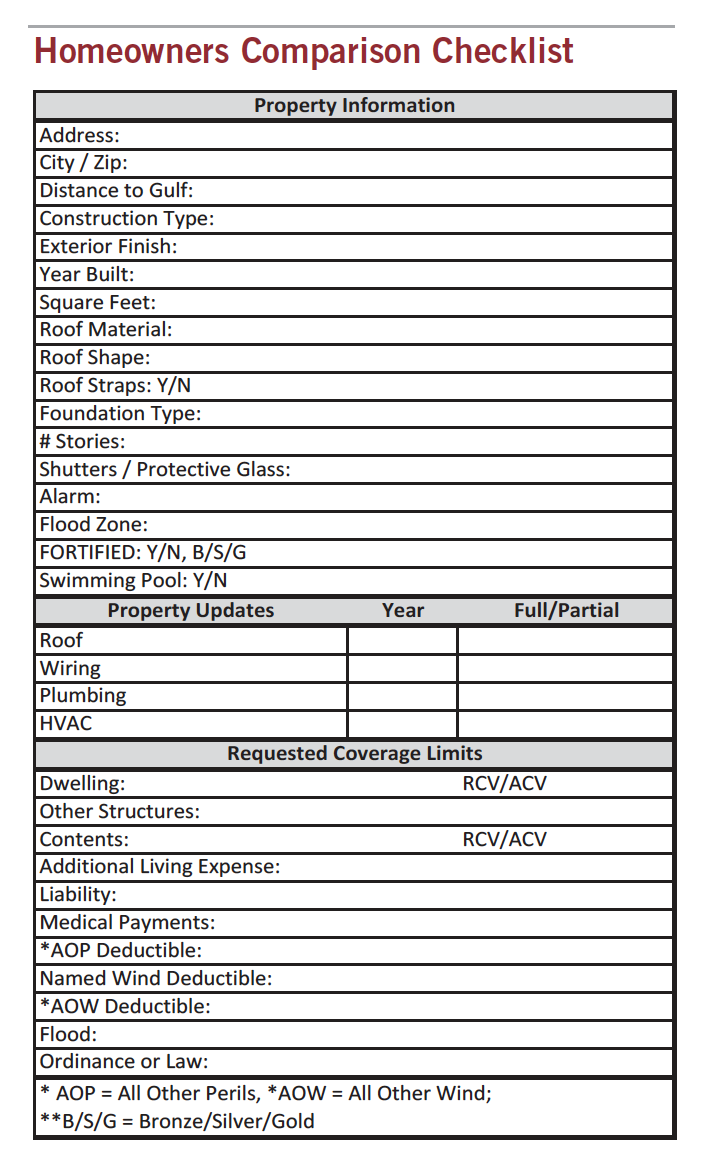

When it comes to comparing insurance policies, consumers are often overwhelmed by the myriad of options available. It is essential to first identify your specific needs, whether it's auto, home, or health insurance. Start by listing out the coverage options you require and the limits you need. Then, compare quotes from multiple insurance providers to see which policies offer comparable benefits at competitive rates. Utilizing online comparison tools can greatly simplify this process, allowing you to view multiple policies side-by-side for easy evaluation.

After you have gathered the necessary quotes, it’s crucial to analyze the fine print. Look beyond the premium costs and evaluate other factors such as deductibles, exclusions, and customer service ratings. Remember, the best value isn't always the cheapest option; sometimes investing a bit more in a policy with better coverage and support can save you money and stress in the long run. Additionally, consider reaching out to current policyholders or checking online reviews to gauge the satisfaction level of others with the insurance provider you are considering.

Insurance Showdown: Coverage vs. Cost - What's the Right Balance?

When it comes to selecting the right insurance policy, understanding the balance between coverage and cost is essential. While a lower premium might seem attractive, it could result in inadequate protection in times of need. It’s critical to consider the extent of coverage provided by a policy, including factors such as deductibles, limits, and exclusions. A policy that seems budget-friendly might leave you facing significant out-of-pocket expenses in the event of a claim.

On the flip side, opting for policies with higher coverage limits often means paying more in premiums. However, this investment can provide peace of mind and financial security, especially for those with valuable assets or increased risks. To achieve the right balance, individuals should assess their unique situation, including their financial standing and personal risk factors. Insurance isn't just about saving money—it's about ensuring adequate protection when it matters the most.

Is It Time to Switch? A Deep Dive into Your Current Insurance Options

When evaluating your current insurance options, it’s crucial to assess whether your policy is serving your needs. Consider the coverage limits and deductibles you currently hold. Is your insurance protecting you adequately against potential risks? A comparison of various plans can reveal gaps in your coverage and potential savings. For instance, many policyholders find themselves overpaying for coverage they no longer need or for features that are no longer relevant. A systematic review of these factors can help you determine if it's time to switch.

Additionally, market conditions and personal circumstances frequently change, impacting the suitability of your insurance coverage. Factors such as shifts in lifestyle, the acquisition of new assets, or even changes in local laws can necessitate an insurance review. By keeping an eye on new insurance providers and updated offerings, you can position yourself to take advantage of better rates or improved coverage. Remember, making an informed decision about whether to switch your insurance can lead to significant savings and enhanced peace of mind.