Dmitriy's Aviation Insights

Explore the world of aviation with expert tips and inspiring stories.

Marketplace Liquidity Models: The Secret Sauce for Thriving in a Wobbly Economy

Unlock the secret to thriving in unpredictable markets! Discover essential liquidity models that can boost your business resilience today.

Understanding Marketplace Liquidity Models: Key Strategies for Economic Resilience

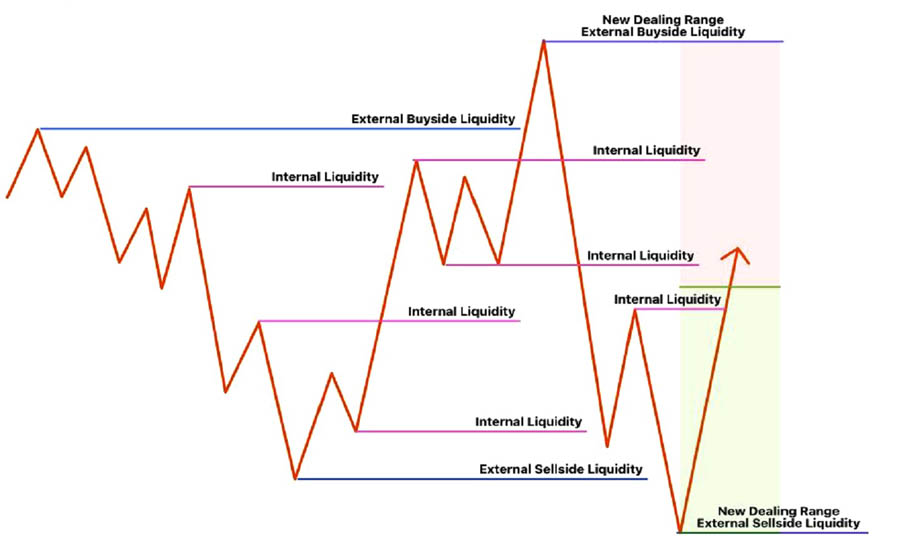

Understanding marketplace liquidity models is essential for businesses aiming to thrive in fluctuating economic conditions. Liquidity refers to the ease with which assets can be bought or sold in a marketplace without affecting their price. In this context, various models exist that can serve as frameworks for enhancing economic resilience. For instance, the order book model allows for real-time updates of supply and demand, which can enhance participant confidence and encourage transactions. Additionally, platforms utilizing a liquidity pool model enable contributors to provide funds, thus ensuring there is always capital available to facilitate trading, and reducing the overall risk of market disruptions.

To effectively implement these liquidity models, businesses should adopt key strategies tailored to their specific circumstances. Firstly, establishing a diversified fund pool can mitigate risks associated with market volatility. Secondly, incorporating advanced analytics can help predict market trends, allowing businesses to adjust their strategies proactively. Engaging with community stakeholders can also create a shared sense of ownership and responsibility, fostering trust and participation in the marketplace. Ultimately, prioritizing liquidity management will strengthen a marketplace's ability to adapt and thrive in challenging economic landscapes.

Counter-Strike is a highly popular first-person shooter game that requires teamwork, strategy, and reflexes. Players can enhance their gaming experience by using a daddyskins promo code for in-game purchases. With various game modes and maps, it continues to attract a dedicated player base and esports enthusiasts alike.

How Do Marketplace Liquidity Models Help Mitigate Economic Uncertainty?

In today's fluctuating economic landscape, understanding how marketplace liquidity models operate is essential for businesses and investors alike. These models enhance the ability to swiftly match buyers and sellers in a marketplace, thereby creating more consistent pricing and reducing volatility. By ensuring that there are always participants ready to transact, liquidity models help maintain a stable environment even in times of economic uncertainty.

Furthermore, effective liquidity models can serve as a buffer against market shocks. For instance, during periods of economic stress, such as financial crises, a well-structured marketplace can facilitate smoother transactions and minimize the impact of sudden price drops. By providing a clear framework for how assets are traded and valued, these models enable participants to make informed decisions, ultimately fostering a more resilient marketplace that can weather economic fluctuations.

Top 5 Marketplace Liquidity Practices to Navigate a Volatile Economy

In a volatile economy, maintaining marketplace liquidity is crucial for businesses looking to navigate uncertain conditions. Here are five key practices to enhance marketplace liquidity:

- Diversify Offerings: Expanding your range of products or services can attract a wider audience and increase transaction volumes.

- Implement Dynamic Pricing: Adjusting prices based on real-time demand can help maintain sales and create a responsive marketplace.

- Enhance User Experience: Streamlining the user interface and reducing transaction times can encourage more frequent purchases.

- Utilize Data Analytics: Leveraging data to forecast market trends allows businesses to make informed decisions, ensuring liquidity during fluctuations.

- Pursue Strategic Partnerships: Collaborating with other businesses increases resource sharing and can stabilize marketplaces during economic downturns.